Are people buying jewelry online?

Yes! And the steady growth of buying jewelry online is likely to accelerate.

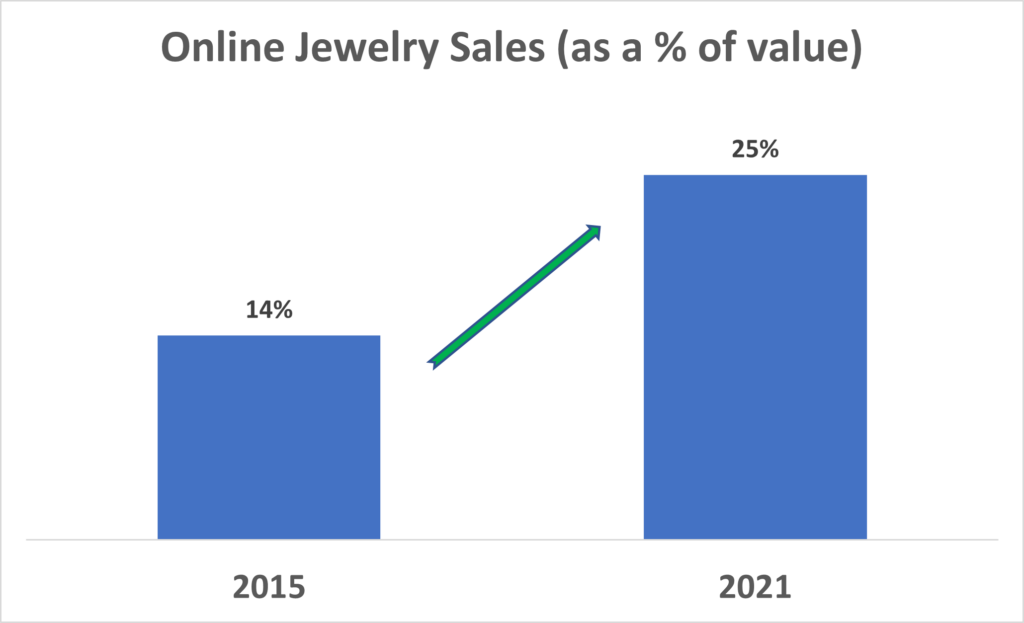

According to DeBeer’s Diamond Insight Report 2022, online diamond and jewelry sales (based on dollars spent) is nearly 25% of all purchases. Compare this to 2015, where only 14% of all sales dollars were through online purchases.

When considering sales growth from a volume perspective, the growth is even more spectacular. In 2021, over 3 in 10 sales (31%) were online. In 2015, less than 2 of 10 sales (18%) were online. However, these stats, which include sales from customers of all ages, hide another very telling stat.

When looking at Gen-Z only, online jewelry purchases jumps to 4 in 10! While Gen-Z only represent 4% of jewelry purchases (in 2020), they are projected to account for 40% of all jewelry purchases by 2035. Needless to say, online jewelry purchasing will likely accelerate as Gen-Zs increase in their purchasing power.

These stats show that people are growing much more comfortable buying jewelry and diamonds online. The process is becoming simpler yet more informative, and protections like free returns and warranties are nearly ubiquitous.

Who are the leading online retailers for jewelry and diamonds.

According to Research and Markets report called “US Diamond Engagement Ring Market Report 2022-2025”, the leading online retailers are:

- Blue Nile (acquired by Signet below in August 2022)

- Amazon

- Signet Jewelers, ltd. (owns Kay, Zales, Jared, et. al)

- Tiffany & Company

All of these brands have specific sections regarding their “safe shipping” methods and return policies. All return policies include outright free returns and/or free returns to physical store options if the brand has them. With this offering, they’ve taken one of the biggest fears out of this high dollar purchase.

It’s important to note, with the exception of Amazon and Blue Nile, Tiffany’s, Kay, Zales and Jared all offer physical locations in conjunction with their online presence. This allows a shopper to have a hybrid experience where they view pieces in person, but purchase the piece online. Doing so with more confidence. If they don’t like the piece, they know they can return the jewelry to a physical store. They won’t even need to interact with customer service to figure out shipping, etc. The DeBeers report refers to this buying experience as “phygital”, and they predict it’s a trend that is here to stay. Whether the purchase ultimately occurs online or digitally, at least some component will occur online. For example, stock availability research and price comparisons are regularly occur online vs. in-person.

Online jewelry purchases are increasing rapidly, but are people spending as much when they buy online?

According to the DeBeer’s 2021 Report, the average in-person purchase, still exceeds an online one. According to their research, the average in-store purchase runs $2,994. Online purchases average $2,204 — oddly, this gap has grown since their 2019 findings.

While the underlying reasons behind this gap isn’t explicitly uncovered in their research, they speculate consumers may prefer in-person inspection and purchase when the prices reach a certain threshold. Other factors could definitely be in play though. For example, the frequently younger online purchaser, may be spending less because they have less to spend. Or, in-store items may be more expensive than their online counterparts. Merchants may feels in-person customers are less price conscious, because they are so much closer to a purchase. Or prices may be higher to account for the added costs of maintaining the physical location.

What does all this mean to you the buyer?

Online purchasing of high ticket jewelry and diamonds is not as unusual as you may have thought. The retailers have taken a lot of the risk out of the process. For example every brand we found offers secured shipping and free returns. Also, the online experience, in our research, is far more option-laden than the in-person alternative.

For example, in a hypothetical purchase we went through on Blue Nile, we received far more information and options than one would receive in-store. We were able to partially customize a ring based on pre-defined pull down menus (ex: design, size, metal, side diamonds, etc.) In the diamond selection section, however, the online experience truly prevailed. You were able to pick from a seemingly endless supply of diamonds based on size, shape, color and quality. There were diagrams of the gem’s inclusion and flaw locations, and a supporting GIA report and appraisal document for every stone.

Finally, once you select your preferred diamond, you are able to pull up a 360-degree view of final piece — with the diamond digitally set in the ring. It is truly comfort-inducing to see the final “product” before the purchase. This is only partially possible in-store, since they can only hold so much inventory as examples.

At minimum, the online offers phenomenal research potential during the purchase process. At best, it fully replaces the need for in-person jewelry purchases.

In the future, physical locations could be elimated entirely. Or companies could maintain a smaller physical footprint for branding, returns, and the occasional luddite purchaser.

Remember, you want to insure your purchase as soon as possible — your homeowners and renters insurances aren’t likely to cover the full amount

You finally received your prized jewelry. You want to wear it and enjoy it…but you need to protect it! The best way to do this, will be through insurance — and in most cases, it will be through a standalone policy.

Your first step should be to call your existing insurance provider. This would be your homeowners or renters insurer. Mention to them that you made a jewelry purchase and you want to see if your policy covers it. Ask the coverage limit on jewelry — this is where this insurance type is often woefully lacking. And what the coverage protection is for loss, damage, and disappearance (also typically limited). In most cases, existing homeowners/renters policies will only cover up to $1,500-$2,500 for jewelry and only for theft. It’s common for them to not cover loss or damage.

Once you uncover these inevitable deficiencies, ask if they offer a “rider” to account for these deficiencies. They will probably have a rider that increases to cover the full replacement amount of the jewelry. But it’s likely the rider is still restrictive on what damage and loss they cover. Be sure to deep dive into this section particularly to understand what events are covered.

Now, factor in that you are still on the hook for any deductible that is already on your existing policy if/when you file a claim. And finally, understand that if you do file a claim for your jewelry, this has the potential to increase the premium on your entire homeowner’s or renter’s policy. Ask them the price of this rider for price comparison purposes against standalone jewelry insurers.

Next contact 2-3 standalone jewelry insurance providers to get quotes. Run through the same exercise of determining the price, the deductible and the protection-level offered. Factor in that a claim on this policy would be separate from any other policy, and these standalone policies are typically more robust in their protection — so it won’t be an exact apples-to-apples comparison. Also, consider that you have the ability to adjust the deductible (in most cases even to $0) to adjust the amount you ultimately pay each year for coverage. Now with these 3-4 prices, you can make a more educated decision on what you are willing to pay to more confidently wear and enjoy you jewelry!

Where can I go to get jewelry insurance buying guidance?

This is admittedly a very abbreviated description of the jewelry insurance purchase process. For a more thorough checklist of the process, email us at: brian@treasureprotect.com